does oklahoma tax inheritance

All the latest breaking UK and world news with in-depth comment and analysis pictures and videos from MailOnline and the Daily Mail. Twelve states and Washington DC.

Does Medicaid Really Take Your Home Oklahoma Estate Planning Attorneys

Get 247 customer support help when you place a homework help service order with us.

. Improving Lives Through Smart Tax Policy. These 13 states may tax borrowers on Bidens student loan relief Loan forgiveness wont trigger federal taxes but some borrowers could owe up to 1100 in state taxes analysis finds. If a will is not present every state or country has a law called intestacy laws that will be the basis for determining inheritance.

During this time the executor will also file the final tax return for the estate and pay any taxes owed. Nebraska had the highest inheritance tax at 18 for distant relations and non-related heirs but at least it doesnt impose an estate tax. Tax is tied to federal state death tax credit.

On average it is nearly 9 in most of the state. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024. The highest federal tax bracket of 35 does not apply to most individual taxpayers until their taxable income reaches 388350.

A state may apply an inheritance tax to the transmission of property by will or descent or to the legal privilege of taking property by devise or descent 398 although such tax must be consistent with other due process considerations. Estate The term used to refer to assets left behind after the death of a person. 744 2013 is a landmark United States Supreme Court civil rights case concerning same-sex marriageThe Court held that Section 3 of the Defense of Marriage Act DOMA which denied federal recognition of same-sex marriages was a violation of the Due Process Clause of the Fifth Amendment.

She has been in the accounting audit and tax profession for more than 13 years working with individuals and. Impose estate taxes and six impose inheritance taxes. The mortgage is a separate document.

Please contact Savvas Learning Company for product support. Edith Windsor and Thea Spyer a same-sex. This replaced Indianas prior law enacted in 2012 which phased out Indianas inheritance tax over nine years beginning in 2013 and ending on December 31 2021 and increased the inheritance tax exemption amounts retroactive to January 1 2012.

The tax burden that your estate has is another factor that could prolong the probate. Inheritance Taxes or Estate Taxes These may be federal or state taxes due after a death. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

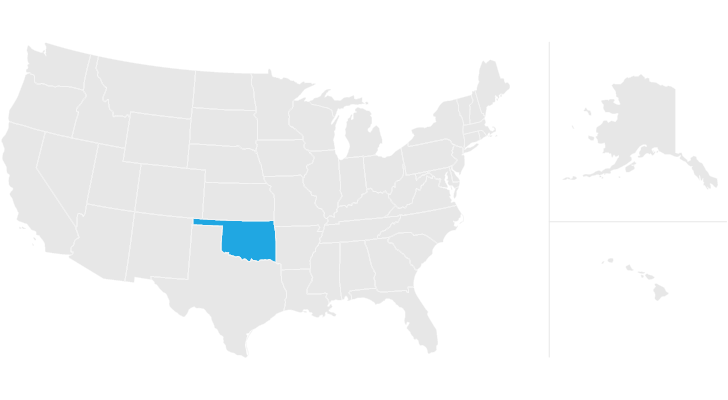

And in. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. The only tax thats steeper in Oklahoma than in the rest of the country is the sales tax.

Alabama policymakers eliminated the states throwback rulea complex and uncompetitive corporate income tax provision that throws nowhere income back into the sales factor of the source stateand decoupled from the Global Intangible Low-Taxed Income. Notable Ranking Changes in this Years Index Alabama. Maryland is the only state to impose both a state estate tax rate and a state inheritance tax rate.

States That Have Repealed Their Estate Taxes. Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa Kentucky Maryland Nebraska New Jersey and PennsylvaniaNotice that Maryland and New Jersey collect both state estate taxes and inheritance taxes. Deed transfers of any kind impact only the ownership and do not change or affect any mortgage on the property.

399 Thus an inheritance tax law enacted after the death of a testator but before the distribution of his. Unlike an estate tax beneficiaries pay the inheritance tax and it is usually due shortly after funds are received by the beneficiary. The Sooner State exempts Social Security.

These beneficiaries are exempt from inheritance tax. State Inheritance Taxes. An inheritance tax is a state-imposed tax that you pay when receiving money or property from a deceased persons estate.

This includes federal and state income taxes as well as any federal estate taxes and state estate taxes. In addition many states also tax the income of trusts. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional state estate tax or state inheritance taxTwelve states and the District of Columbia impose estate taxes and six impose state inheritance taxes.

By comparison the tax rate for single taxpayers on taxable income of 11650 is only 15. Beneficiaries and heirs will pay any federal or state impose inheritance tax once their inheritance is disbursed. Inheritance tax is a flat tax on the value of the decedents taxable estate as of the date of death less allowable funeral and administrative expenses and debts of the decedent.

Pennsylvania does not allow the six-month-after-date-of-death alternate. Is Oklahoma tax-friendly for retirees. It has no estate or inheritance tax.

If the estate has real estate in multiple states you may have to go through separate probate processes which may or may not delay the distribution of assets. Oklahoma has low property taxes with most homeowners paying less than 1300 annually. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

This is important in a divorce situation where one spouse may quitclaim the property to the other but this does not remove either spouses name from the mortgage and the responsibility to pay it. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. This is particularly true if you have to deal with estate taxes.

Maryland is the only state to impose both. Oklahoma citation needed Pennsylvania. Taxable trusts have a very small exemption of only 100.

State laws change frequently and the preceding information may not reflect recent changes. It does not avoid or minimize estate taxes. Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025.

State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma. Some taxes are paid by the. The federal government does not impose an inheritance tax.

Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. In 2019 for example the wealthiest families reported average inheritances of 719000 while the poorest families those who received any inheritance at all reported an average inheritance of. OK ST Title 68 804.

Oklahoma Hand Written Wills Tulsa Probate Attorneys Kania Law Office

Probate Attorney Cortes Law Firm

Understanding Conventional Life Estates

Cost Of Dying In All 50 States Gobankingrates

How Long Will It Take To Probate My Father S Estate Oklahoma Estate Planning Attorneys

Oklahoma Estate Tax Everything You Need To Know Smartasset

Do I Need To Pay Inheritance Taxes Postic Bates P C

Do I Need To Pay Inheritance Taxes Postic Bates P C

Probate Sale Can You Sell An Inherited Property Before Probate

Oklahoma Hand Written Wills Tulsa Probate Attorneys Kania Law Office

Do I Need To Pay Inheritance Taxes Postic Bates P C

What Can A Beneficiary Do If A Trustee Is Non Responsive Oklahoma Estate Planning Attorneys

Do I Need To Pay Inheritance Taxes Postic Bates P C

Do I Need To Pay Inheritance Taxes Postic Bates P C

Paycheck Calculator Oklahoma Hourly 2022 In 2022 Paycheck Ways To Save Money Save Money Fast

Best Worst States To Retire In 2022 Guide

Irrevocable Trusts In Oklahoma Tulsa Estate Planning Lawyers Call Now

Oklahoma Estate Tax Everything You Need To Know Smartasset

Editable Oklahoma Last Will And Testament Template Sample Last Will And Testament Will And Testament Living Will Template